Workplace financial

wellness solutions from ADP

Retirement Services

Boost employee engagement and inspire your team to get on the path to lasting financial wellness with ADP’s leading retirement plan features, educational resources and tools.

Financial wellness for retirement: Crucial for employees, vital to your business

When you partner with ADP, you won’t just increase employee loyalty and satisfaction through our workplace financial wellness solutions, you’ll also help decrease the financial stress that affects employees’ work. We’ll help your people with:

- Education & Resources: Understand financial wellness with personalized journeys

- Tools: Build healthy habits through the use of an effective suite of tools and calculators

- Plan Features: Stay on track with financial wellness solutions for retirement that meet the range of employees’ needs and goals

With the support in place to help them become more financially secure, employee productivity will increase — call it a win-win. ADP’s tools and resources can help you set up a comprehensive financial wellness program for retirement, providing personalized financial guidance that will help employees manage their financial lives and reduce money-related stress in the process.

Why you should offer retirement plans and support financial wellness for employees

Businesses that offer long-term financial wellness initiatives and programs report that they are more likely to hire and hold on to employees, increase productivity and improve well-being.

Performance

9/10

Nine out of 10 business owners say offering a retirement plan positively impacts employee attitude and performance.1

Employees’ well-being

40%

Of employees are affected by financial stress and report that it reduces their productivity at work.2

Recruitment & retention

90%

Of business owners say retirement plans give them a competitive edge in hiring and retaining employees.1

Financial education that makes a

long-term difference

With a deeper understanding of the intricacies of financial wellness planning for retirement can help your people come closer to reaching financial wellness. Help them learn ways to save and plan for the future with our:

- Webinars

- Podcast series

- Events

- Video library

- Articles, insights and more

Tools to help your employees get more from their finances

Wherever your employees are in their financial journey, the right financial wellness check-up tools can help them to make the most of their money now — and in the future — by budgeting, planning and more.

- Mobile app

- Calculators

- Online assessments

- Automatic savings options

Position your employees to tackle

financial challenges

Offer the programs, products and advice your employees need to build a

holistic plan that helps them reach their long-term financial goals.

Help your team members plan for their long-

term financial well-being

From defining goals and retirement contribution amounts to monitoring progress and more, we’ll help your participants feel more confident and in control of their finances.

- Guided Enrollment for sound retirement savings decisions

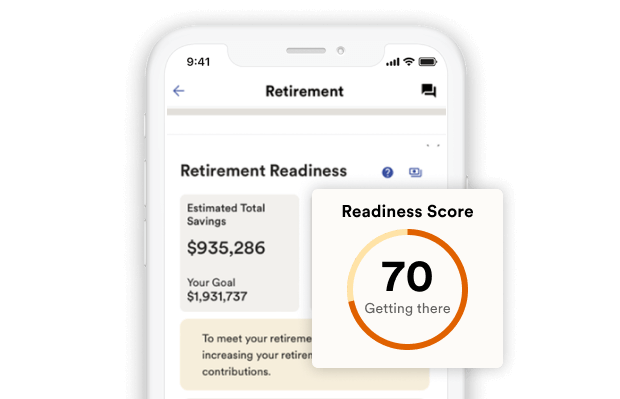

- MyADP Retirement Snapshot® to take the guesswork out of retirement planning

- Retirement Readiness Tool for participants to track their retirement goals

- Smart-Save allows participants to annually increase their deferral rate

- Calculators and planning tools for salary, retirement, budget and investment decisions

Position your employees to tackle financial challenges

Our intuitive, personalized education journeys help prepare your employees for life’s financial challenges and make informed workplace financial wellness decisions. Having real-time access to a wide array of educational content instills financial confidence in your team, helping to engage employees and put them in a position to achieve financial freedom before retirement.

- Targeted Emails help workers make more confident, informed decisions

- Financial Wellness Library with videos, articles, infographics and online courses

- Retirement Success Webcast Series covering relevant and timely topics

- Retirement Success Pod(k)ast Series exploring basic financial topics, retirement news, insights and thought-leadership topics

Offer your team tailored investment advice,

student loan matching programs and more

Through our robust retirement plan offering, we bring together carefully selected financial wellness solutions that address the range of employees’ needs and goals.

- Participant Advisory Services offer access to personalized investment advice

- Student Loan Match Program with contribution-matching on qualified loans

- Student Loan Optimization Program provides valuable education content and resources on student loans and saving for college

- Retirement Income Solutions® let participants convert retirement savings into a stream of reliable income

Over 1.1 million clients count on ADP

With decades of expertise, ADP is uniquely positioned to help growing businesses stay agile while empowering their people. We’re constantly innovating so you can succeed — today and in the future.

Retirement resources

Guidebooks, insights and case studies to help your team learn more about retirement planning, investment strategies and overall financial management.

Guidebook

We help you boost employees' financial wellness

Insight

A Crisis in Retirement Confidence: Employees Aren't Financially Ready

Insight

Financial Wellness Check-up: Are Your Employees Feeling Fiscally Fit?

- ebri.org Issue Brief, February 1, 2024.

- Visa Financial Wellness Research, Sept 2023, commissioned by ADP

- PLANSPONSOR 2024 Survey

Retirement Readiness makes no assumption about your tax status, savings, early withdrawal penalties, required minimum distributions and should not be used as the primary basis for any planning decisions. The likelihood of various retirement savings outcomes are hypothetical, do not reflect actual investment results, or market fluctuations and are not guarantees of future results. It does not portray actual investment results or guarantee future results.

The Retirement Success Pod(k)ast may contain information and opinions derived from proprietary and nonproprietary sources deemed to be reliable. The accuracy of those sources are not guaranteed, and the podcast does not recommend, compensate or endorse third-party guests, products or services. ADP Retirement Services, ADP Broker-Dealer, Inc. is a division of ADP, Inc.

MyADP Retirement Snapshot(R) makes no assumptions about your tax status or savings and should not be used as the basis for any planning decisions. The likelihood of various savings outcomes are hypothetical, do not reflect actual investment results or market fluctuations and are not guarantees of future results. Results may vary potential savings scenarios, with each use and over time.

M-596712-2024-08-23